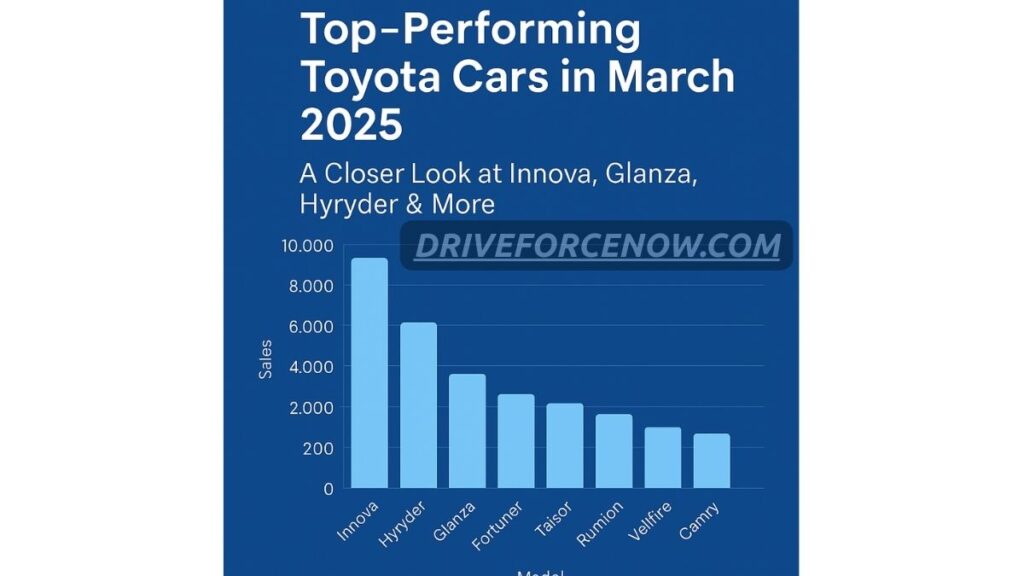

Toyota Kirloskar Motor posted a strong March 2025 with 28,373 units sold domestically—a healthy 13% growth from March 2024 on a year-on-year basis. Month on month, sales were up 7%, signaling a good closure to the financial year. But what models powered this growth? Which ones faltered?

Let’s dissect the model-wise performance of Toyota and see what the figures say about each of their cars, ranging from the evergreen favorite Innova to the compact but robust Glanza and feature-packed Hyryder.

Toyota Innova & Hycross – Reliable Powerhouses

The Toyota Innova, along with its cousin the Innova Hycross, remains the company’s top-selling segment. With 9,856 units sold in March 2025, it remained almost flat from last year’s 9,900 units but increased 17% from February 2025.

Why It Matters:

The Innova is regarded as the perfect family and commercial MPV.

Hybrid and petrol models are becoming increasingly popular.

Strong brand loyalty and after-sales service continue to be major strengths.

Toyota Hyryder – Mid-size SUV with Momentum

Urban Cruiser Hyryder, which is a result of the Toyota-Suzuki partnership, sold 5,286 units, down 11%

YoY but up 23% MoM. The recent facelift that added new features must be the reason behind the

sales surge.

Highlights:

Panoramic sunroof and digital cluster features draw premium customers.

The hybrid variant is picking up pace in metro cities.

Direct competitor to Hyundai Creta and Kia Seltos.

Toyota Glanza – Compact Hatchback Faces Pressure

The Toyota Glanza—the badge-engineered sibling of the Maruti Baleno—struggled this month, posting only 3,501 units, which is down 19% YoY and 24% MoM.

Reasons Behind the Drop:

Increased competition from Tata Altroz and Hyundai i20.

Shift in consumer preference toward compact SUVs.

Lack of recent updates compared to competitors.

Toyota Fortuner – Full-Size SUV Holds Its Ground

The powerful Fortuner recorded 3,392 units, a bit less than March 2024’s 3,621 units, but a healthy 18% MoM growth indicates it’s still in demand even at its premium prices.

Fortuner’s Strengths:

It has a tough road presence and dependable off-roading.

Diesel versions are still favorites in North and West India.

Strong resale value and service network support.

Toyota Rumion – MPV Surprise Performer

The Toyota Rumion recorded a gigantic 161% YoY jump, selling 1,793 units in March 2025. While a 15% decline from February, it remains a surprise bundle.

Why It’s Gaining Attention:

A budget-friendly rebadged MPV from the Maruti Ertiga.

Reaches out to cost-conscious family buyers.

Improved fuel efficiency and low maintenance costs.

Toyota Taisor – Newcomer on the upswing

The Urban Cruiser Taisor, Toyota’s new compact SUV offering, clocked 3,468 units in March. It’s already looking good in its first month.

Key Features:

The platform is based on the Maruti Fronx.

Dual-tone schemes and a contemporary infotainment system.

Ready to take on the Renault Kiger and Tata Punch.

Toyota Vellfire – Premium Surge

Premium MPV Vellfire recorded a staggering 346 units, which is a mind-boggling 811% YoY and 1,721% MoM increase. Backlog deliveries and demand in the luxury market contributed immensely here.

Hilux & Camry – Niche Yet Noteworthy

Hilux pickup: Sold 528 units (up 48% YoY), gaining traction in tier-2 cities.

Camry sedan: Managed 203 units, which is a dip probably due to changing interest in SUVs.

Total Market Insight

| Model | Mar 2025 Sales | YoY Growth |

| Innova + Hycross | 9,856 | 0% |

| Hyryder | 5,286 | -11% |

| Glanza | 3,501 | -19% |

| Fortuner | 3,392 | -6% |

| Taisor | 3,468 | New Entry |

| Rumion | 1,793 | +161% |

| Hilux | 528 | +48% |

| Vellfire | 346 | +811% |

| Camry | 203 | -13% |

Future Perspective for Toyota India

In the future, Toyota is gearing up for its initial electric vehicle launch in India on the Maruti Suzuki e-Vitara platform. Its Urban Cruiser BEV will include:

Dual battery packs

More than 500 km range

DC fast charging capability

Premium touches such as a panoramic sunroof and 6 airbags

This indicates Toyota’s willingness to combine functionality with innovation while responding to India’s changing mobility requirements.

Conclusion

Toyota continues to illustrate market dominance with a combination of tried and tested performers such as the Innova and Fortuner and fresh, promising players such as the Taisor and Rumion. While such offerings as the Glanza and Camry might require a strategic overhaul, the March 2025 picture in aggregate appears to be healthy.

With shifting consumer tastes towards SUVs and hybrid technology, Toyota’s flexible product mix keeps it at the vanguard of India’s automotive industry.